Speed: Auto trading can execute trades much faster than manual trading, taking advantage of even the smallest market movements.

Emotion-Free Trading: You can test strategies on historical data before deploying them with real money.

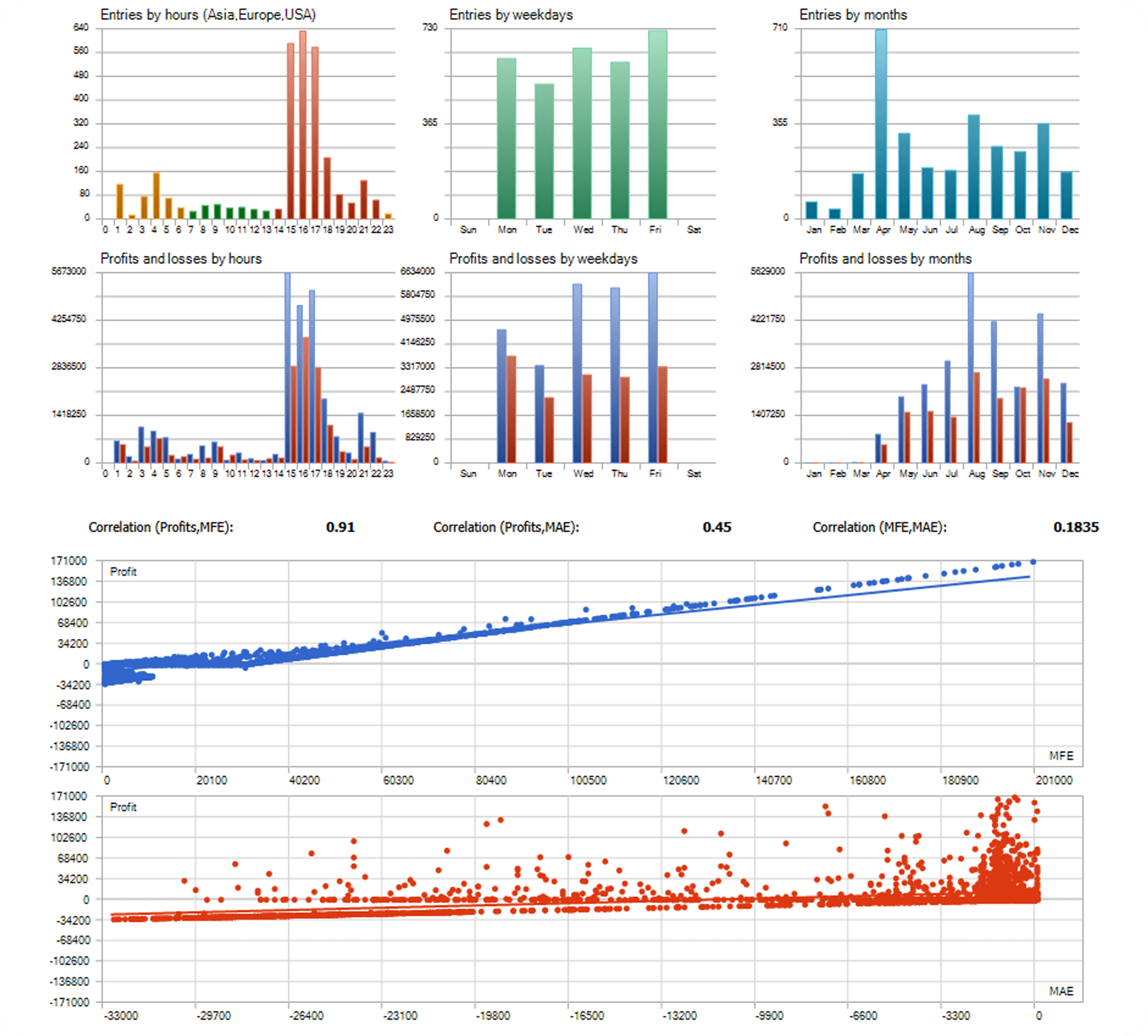

Backtesting: You can test strategies on historical data before deploying them with real money.

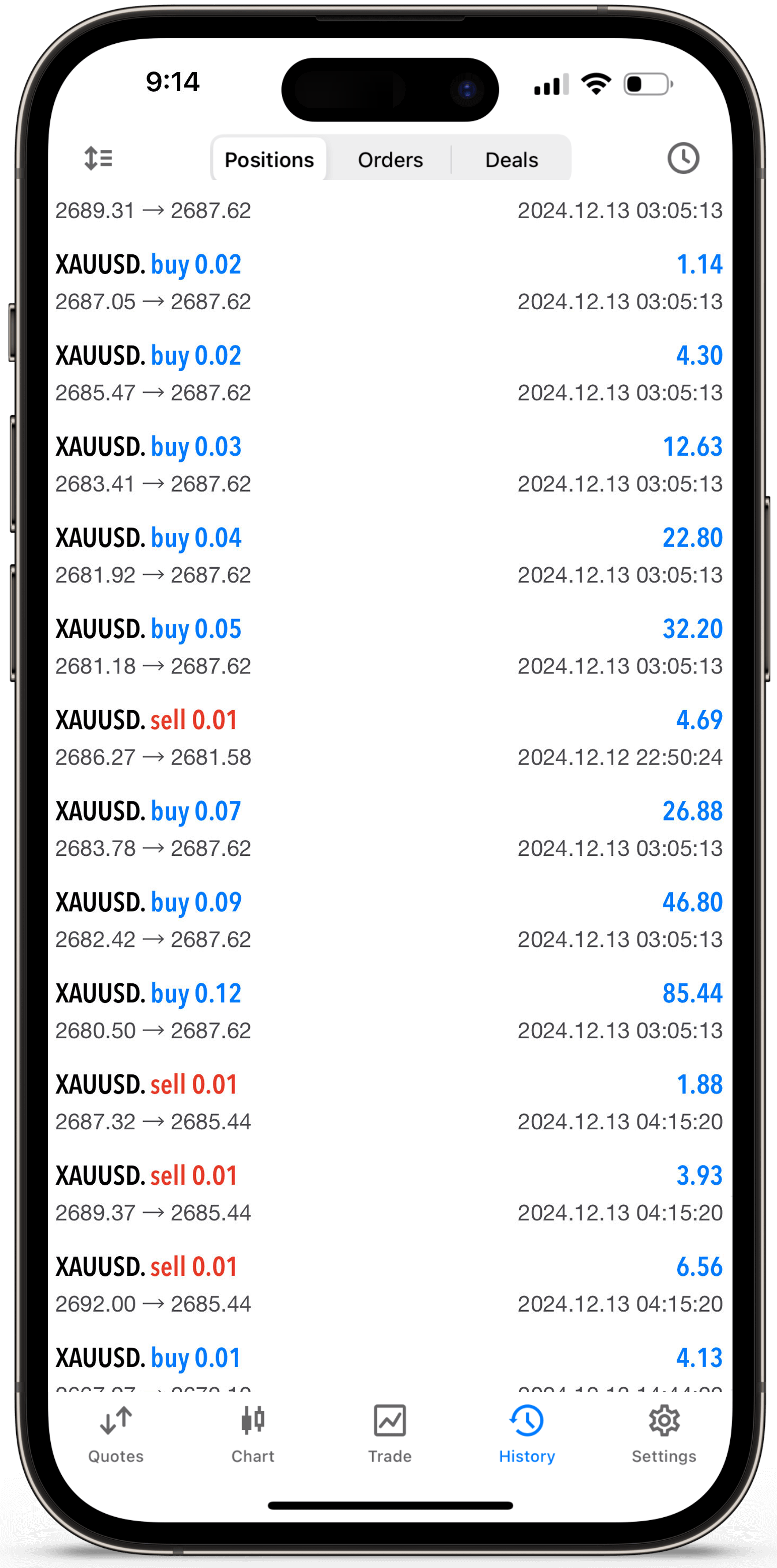

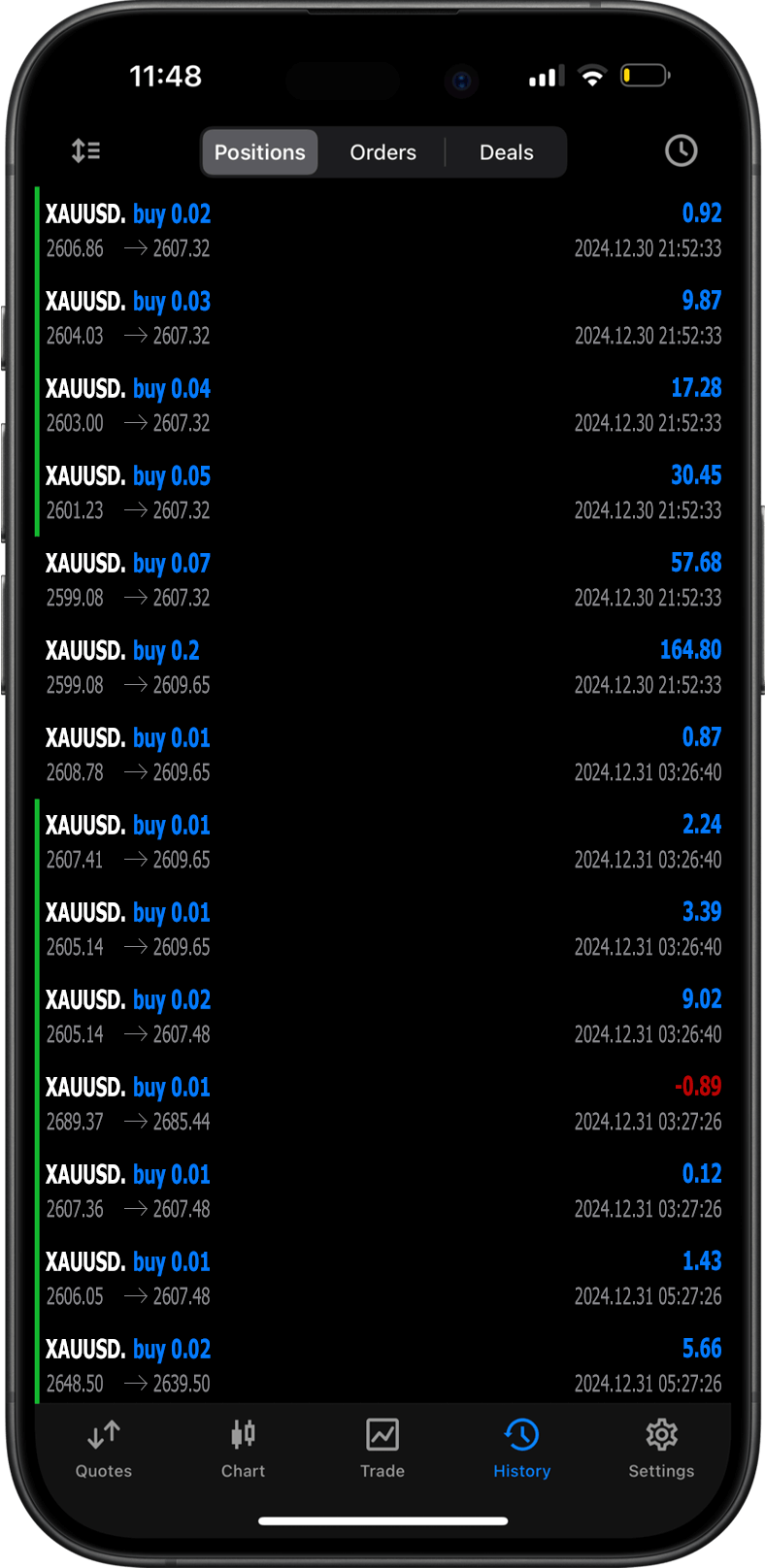

24/7 Trading: Auto trading systems can operate around the clock, especially in markets like forex and cryptocurrency that never close.

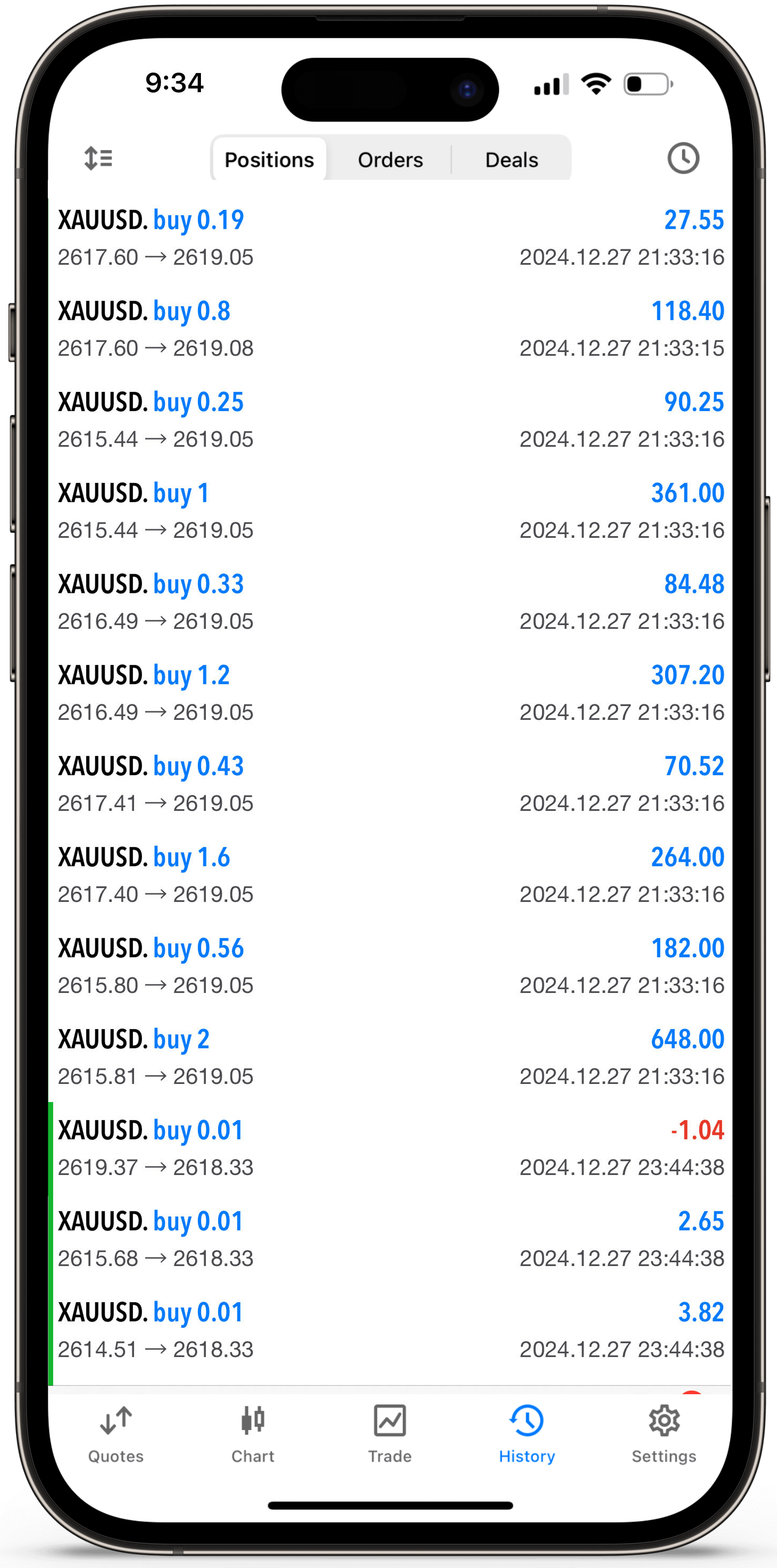

Risk Management: Auto trading software often includes built-in features for risk management, such as stop-loss and take-profit orders.

Choose a Platform: Select an auto trading platform that fits your needs (e.g., MetaTrader, TradingView, or Platform)

Create an Account: Sign up with your broker or exchange and link it to the auto trading software via an API.

Select a Strategy: Purchase the EA Software.

Backtest your strategy: Run the strategy on historical data to assess its viability.

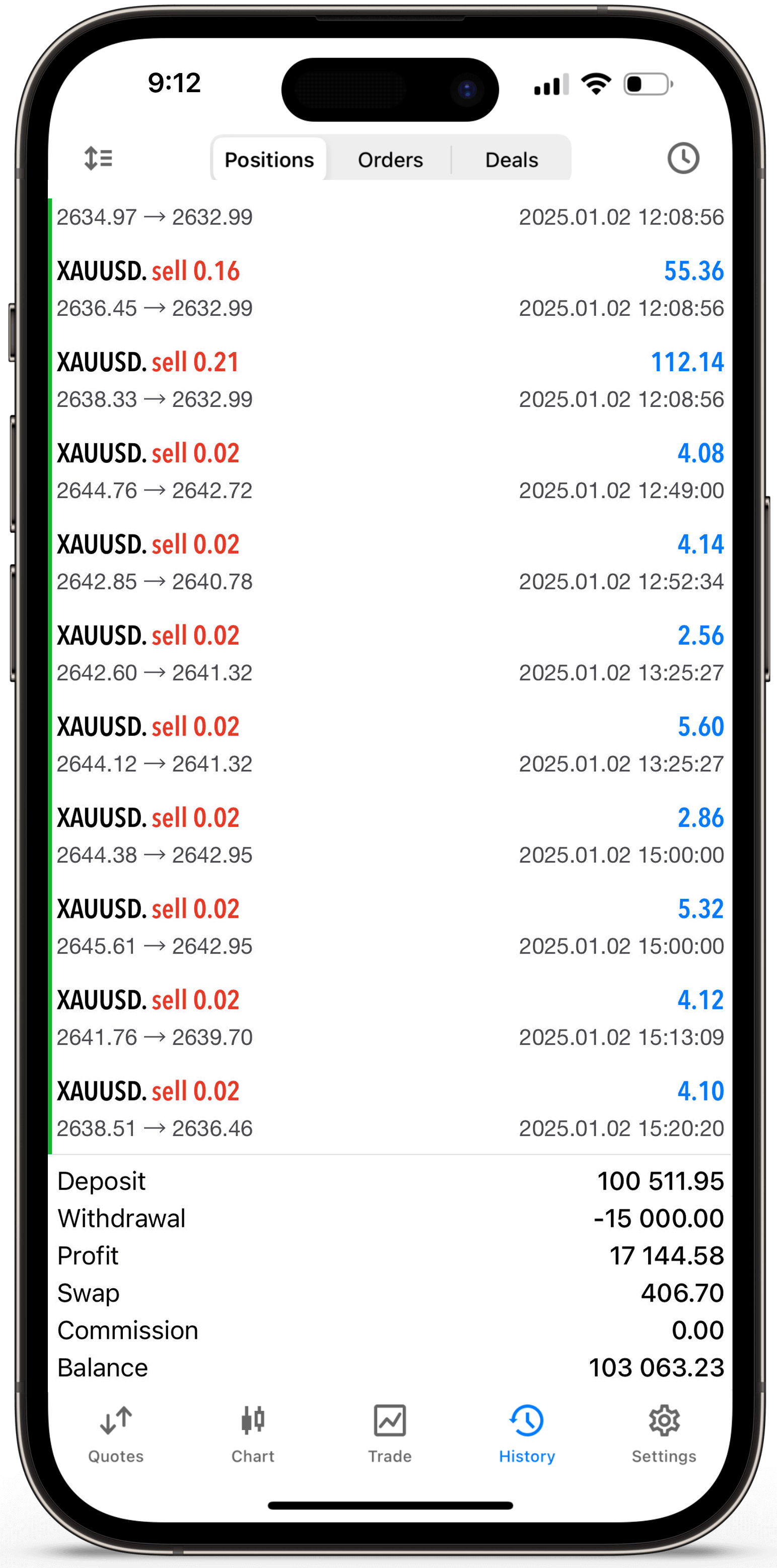

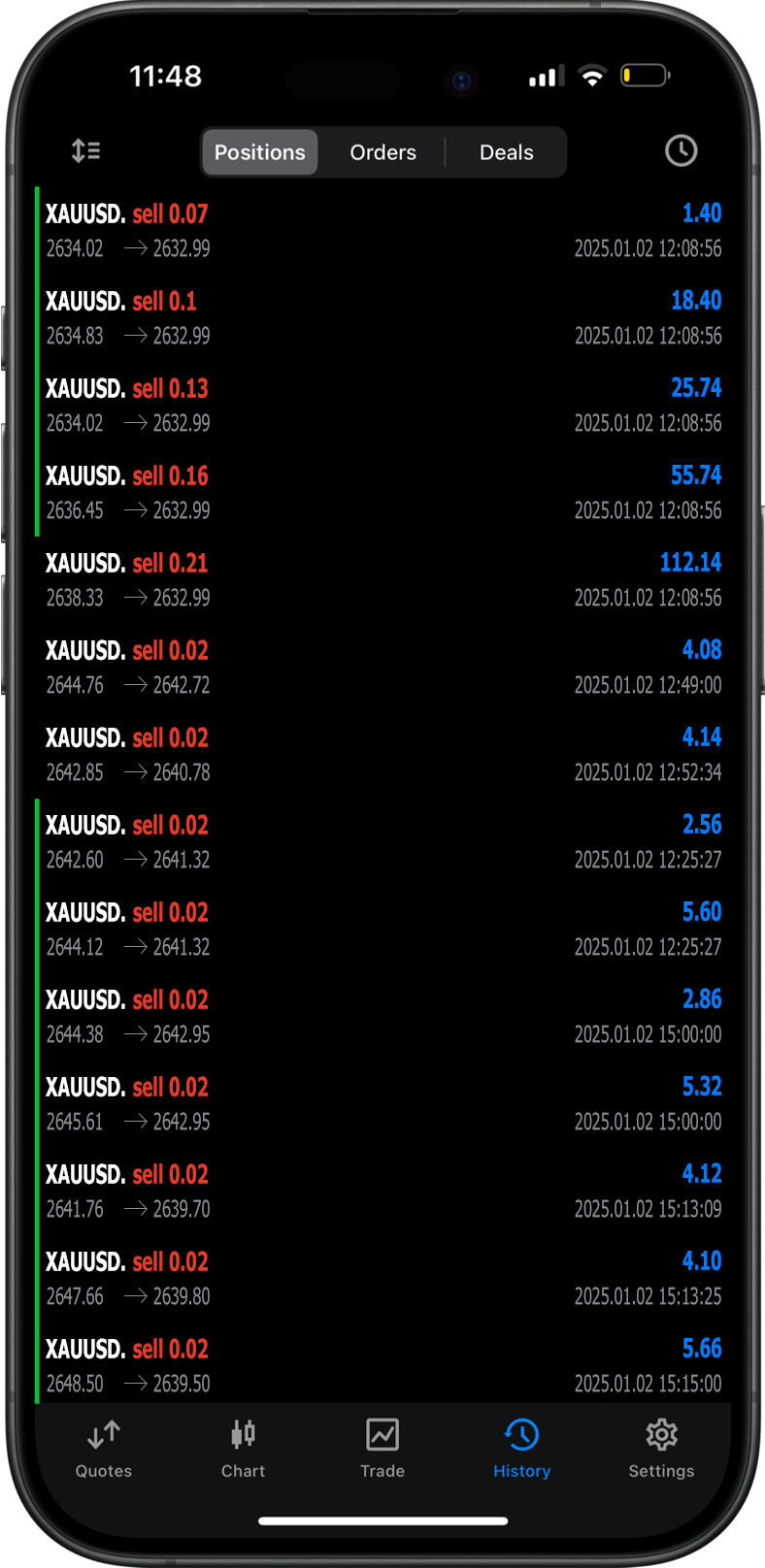

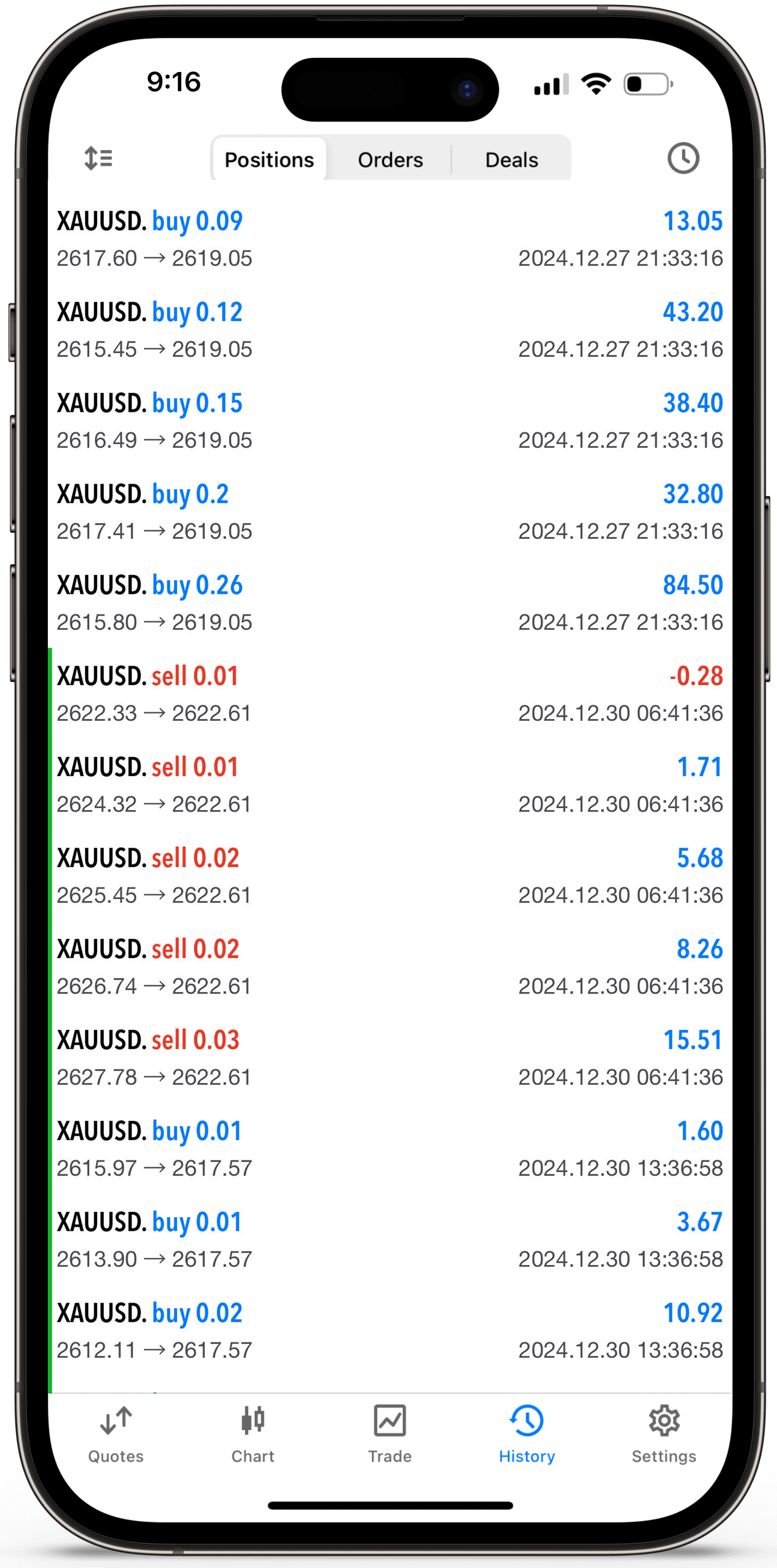

Go Live:. Once you're confident in your strategy, deploy it with real funds

Ensure the platform uses strong encryption for data and transaction security.

Use two-factor authentication (2FA) to protect your account.

Regularly monitor the performance of your system to identify any irregularities.

Always test strategies in a demo account first to mitigate risk.